Happy New Year! We hope you enjoyed the holidays.

As we start 2023, we would like to take a moment to thank you for your continued support of Fort Point Capital, and recap of our activities from 2022. This past year has been an active one for us as we closed on our third fund, completed several platform and add-on investments, and had a successful exit. We also grew our team and celebrated well deserved promotions. We look forward to continuing our work together, and hope that 2023 is another successful year for all of us.

FPC Fund III

We closed our third private equity investment fund, FPC Small Cap Fund III, LP. Fundraising began in March 2022 with an initial target of $250 million and was oversubscribed, closing at the offering’s hard cap of $340 million. Our Fund strategy will remain consistent with what has driven our success to date, continuing to partner with excellent management teams and entrepreneurs to build market-leading business-to-business services companies. Since the firm’s inception in 2010, we have raised more than $630 million in equity commitments across various investing entities and have invested in 15 platform companies and 25 add-on acquisitions.

Forming New Partnerships

We welcomed three new leading service providers to our portfolio.

Based in Cincinnati, Ohio, Jones Fish is an industry leading provider of professional pond and lake management services. The Company offers a range of services including annual, recurring pond and lake treatment services, fish stocking, aeration systems and services, algae and aquatic weed management, and other related services.

Based in Toronto, Ontario, Nova is a leading provider of creative automation software for digital advertising that enables advertisers to repurpose creative assets originally developed for social platforms to be easily distributed across the open internet, mobile apps and connected TV. Nova’s core offering allows agencies, ad-tech platforms, publishers, and brands.

Based in Eastpoint, FL, ROX360 is a tech-enabled marketing platform that provides technology-driven logistics / fulfillment services and customer retention services for vacation rental management (“VRM”) customers. By partnering with ROX360, VRMs can seamlessly offer their customers beach and recreation equipment, and local experiences, enhancing the vacation experience.

Joining Forces

Our Portfolio companies continued their growth via acquisitions.

Barrington Media Group completed the acquisition of Thesis Testing, a leading provider of conversion rate optimization (CRO) digital marketing services, as well as The SEO Department, a search engine optimization leader that works as an extension of the client’s management team to drive ROI.

Jones Fish completed the acquisition of Advanced Technical Aquatic Control (“A.T.A.C.”), a leading provider of recurring pond and lake management services to developers, land management professionals and private homeowners.

Strata Information Group completed the acquisition of akaCRM, a Salesforce top-tier premium partner providing comprehensive advisory, implementation and managed support services for Salesforce and Conga in the higher education, K-12 and non-profit end markets.

Capitalizing on our Efforts

We entered into a definitive agreement to sell our home décor distribution platform, Sullivans, to a private equity firm. Since our investment in 2014, we have helped to transform Sullivans from a founder-owned business into a well-recognized leader and platform for consolidation in the home décor distribution industry.

During our hold, Sullivans made significant investments in its management team, established and built out its digital department and implemented an enhanced sales and marketing strategy to extend its market leadership and drive strong organic growth across all channels. In addition, Sullivans successfully executed and integrated two add-on acquisitions, expanding the Company’s product breadth and entering the outdoor décor space. Sullivans is another example of our commitment to investing in the value-added distribution sector.

Growing our Team

We made several new hires to our investment team.

New Additions: In July, Michael Duffy joined our firm as Vice President on the investment team, as well as Kyle Petrillo and James Clayton, who joined in August as Associate and Senior Analyst, respectively. Michael, Kyle, and James will primarily focus on supporting portfolio companies and executing new investments in the business-to-business services sector.

Promotion: David Gagliardi was promoted from Vice President to Principal. David has been a key part of Fort Point’s growth for several years. Since joining the firm in 2015, David has been responsible for new investment opportunity origination, transaction execution and portfolio company oversight.

About Fort Point Capital

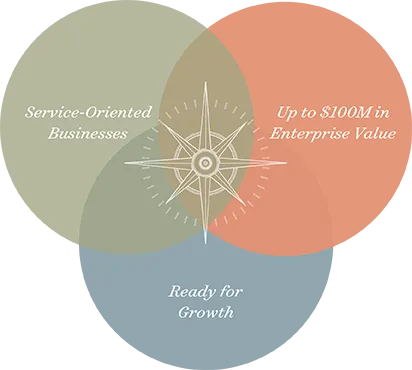

Fort Point Capital brings a management-led, growth-oriented approach to private equity investing, targeting fragmented sectors of the business services industry. Founded in Boston in 2011, Fort Point partners with founders and management teams to accelerate growth and performance. Fort Point provides resources to help companies expand teams and infrastructure, improve service offerings, access new markets, and support follow-on acquisitions. Fort Point fulfills its commitment to management, employees and shareholders by employing a repeatable process to drive durable value, showcased in over 40 acquisitions since the firm’s inception. Fort Point Capital is currently investing from FPC Small Cap Fund II. To learn more, please visit fortpointcapital.com.

Investment Criteria

Transaction Profile

- Control Buyouts and Add-ons

- $20-$100 Million in Enterprise Value

- $15-$50 Million in Equity

Service-Oriented Business Model

- Business Services

- Information & Software

- Marketing & Media

- Transportation & Logistics

- Industrial & Testing

- Healthcare Services

Company Attributes

- Service-oriented Business Models

- Niche Market Leader

- Strong Customer Loyalty

- Growth-oriented

- High Margins

- Stable Earnings Base

We are actively investing our third Fund in service-oriented companies across a broad range of sectors. We invite you to speak with us and discuss potential acquisition opportunities.

Sincerely,

Brooke Ablon, Partner bablon@fortpointcapital.com

Paul Lipson, Partner plipson@fortpointcapital.com

Christina Pai, Partner cpai@fortpointcapital.com

Mike Hermsen, Advisory Partner mhermsen@fortpointcapital.com

David Gagliardi, Principal dgagliardi@fortpointcapital.com

Michael Brofft, Vice President mbrofft@fortpointcapital.com

Michael Duffy, Vice President mduffy@fortpointcapital.com

Kyle Petrillo, Associate kpetrillo@fortpointcapital.com

James Clayton, Senior Analyst jclayton@fortpointcapital.com

Justin Shin, Director of BD jshin@fortpointcapital.com